Did Covid-19 spur digital currency development? (as published in The Edge on May 22, 2020)5/23/2020 Did Covid-19 spur digital currency development?

By Emir Hrnjic With people observing social distancing measures during the COVID-19 pandemic, a serious concern has emerged. Can the virus spread via physical money? One research seems to suggest so – tests conducted found that some notes and coins may carry as much bacteria as those present on the soles of shoes or even toilet seats. In March, the World Health Organization confirmed that banknotes may carry the coronavirus for several days and advised the use of contactless payments instead. Amid the heightened hygiene awareness, digital currencies came to focus Improbably, the Covid-19 crisis might have prompted central banks to expedite this development. Recently, the head of the Bank of International Settlements (BIS) Innovation Hub Benoît Cœuré said “the [COVID-19] crisis has exposed the value of technologies which enable the economy to operate at arm’s length and partially overcome social distancing… The current discussion on central bank digital currency also comes into sharper focus.” China leading the way While the rest of the world has been discussing and analysing the benefits and costs of digital currency, China’s central bank—the People’s Bank of China (PBOC)— had seized the moment and started a pilot test of the digital yuan, the electronic form of the renminbi with value equivalent to the paper notes and coins in circulation. It has since become the first major economy to introduce a central bank digital currency (CBDC), rolling out the pilot test in three cities, including Shenzhen, Suzhou, and Chengdu, as well as in the Xiong’an New Area. Also known as “DC/EP (Digital Currency/Electronic Payments),” the digital yuan transactions can be made through smartphone–based NFC technology (Near Field Communication). The technology enables the phones to interact with each other when in close proximity and, thus, allows the digital currency to be exchanged without the internet. Mobile cashless payments – like Alipay or WeChat pay – have become a part of daily life in China. But the launch of digital yuan – coupled with a recent President Xi Jinping’s call for China to focus more on blockchain – exemplifies China’s continuous push to become the world’s leader in digital currency space. Moreover, digital yuan may even pose a threat to the dollar’s supremacy as an international means of payment. Mainland based English newspaper China Daily went as far as to claim that “[China’s] digital currency provides a functional alternative to the dollar settlement system and blunts the impact of any sanctions or threats of exclusion both at a country and company level… It may also facilitate integration into globally traded currency markets with a reduced risk of politically inspired disruption.” Pros and cons While it may be too early to evaluate China’s experiment, central banks around the world are paying great attention to this development while carefully observing pros and cons of digital currency. The truth is, central banks have been studying the use of blockchain technologies for years. The Bank for International Settlements (BIS) views potential CBDCs favourably as they would be backed by the government, and the money supply would be controlled by the central bank. Furthermore, the early versions of the US stimulus bill flirted with the development of a digital US dollar to disburse economic stimulus payments, while The European Central Bank recently released a working paper analysing merits of its potential digital currency. The pros are there. A Bank of England’s study in 2016 on the feasibility of digital currency pointed out that it could increase Growth Domestic Product (GDP) “by as much as three percent.” The usage could also “improve the central bank’s ability to stabilise the business cycle.” Following the rise of cryptocurrencies such as bitcoin, the secure digital transfer of money has become paramount. While Bitcoin’s extreme volatility and low transaction processing capacity hinder its ambition to become a global medium of exchange, digital currency issued by a central bank has a far greater potential to become a trusted medium due to inherent low volatility as well as potential for greater efficiency, lower transaction costs, and large scale. CBDCs would likely help monetary policy targeting money supply and enable access to real-time data regarding money demand. At the same time, blockchain could support faster, auditable, and in general more transparent interbank settlement systems at decreased settlement costs, while avoiding issues like single point of failure. As societies become immersed in digital payment, central banks which roll out digital currency could gain the first-mover advantage. Any central bank ignoring the role of digital currency could risk losing relevance in the global economy. Challenges to overcome However, the transition to digital currency adoption needs to be carefully managed. One challenge to overcome is the potential shortfall in credit. As the head of Germany’s Bundesbank, Jens Weidmann once argued, in uncertain economic times, people may choose to put their money as digital currency in central banks, instead of deposits in commercial banks as the former is more secure and holds lesser risk. With reduced deposits also comes a severe contraction of consumer credit which would clearly harm the real economy. As central banks’ digital currency looks set to take on a bigger role in future, commercial banks would have to find alternative sources to replace the deposits. The PBOC are aware of this shortcoming: They did not want digital yuan to become a threat to the retail banking system. For this reason they did not make it available directly to the public. Instead, the digital yuan will be used by the PBOC and commercial banks for settlement of transactions which may increase transparency of the Chinese banking system and create more stability. PBOC’s playbook calls for implementation of a two-tier system – the central bank will create the digital currency and issue it only to large financial institutions and four largest state-owned banks that will further distribute it to China’s 1.4 billion citizens, just like the issuance of cash. Another major challenge is privacy. Digital currency enables digital tracing of all digital cash in circulation and, thus, a person’s use of finances. While this considerably helps authorities to fight money laundering, terrorist financing, and even tax evasion, it also facilitates close surveillance and control of individuals’ transactions. In countries where privacy is a great concern, this may lead to serious public opposition. Even though PBOC promised to keep the balance between privacy and supressing criminal transactions, it remains unclear how it can achieve balance between these diametrically opposite objectives. Early reports hint at limits in the frequency and amounts involved in anonymous transactions. As an improbable consequence of COVID-19 crisis, CBDCs were brought in focus and governments might have been prompted to expedite their development. Seizing the moment, China’s central bank made major steps toward becoming the first major economy to issue a CBDC. How other central banks follow suit will be something that markets will play close attention to.

0 Comments

Digital Currency Can Impact Monetary Policy (as published in Business Times on May 14, 2020)5/23/2020 By Emir Hrnjic

The People’s Bank of China (PBOC) has reportedly begun a pilot test of the digital yuan in April, thus, becoming the first major economy to introduce a central bank digital currency (CBDC). The experimental trials started in three cities, including Shenzhen, Suzhou, and Chengdu, as well as in the Xiong’an New Area and digital yuan became part of the monetary system. Together with President Xi Jinping’s recent appeal for greater urgency in the development of blockchain, the pilot launch of digital yuan epitomizes China’s ambition to become the digital currency leader. Moreover, state-media outlet China Daily claimed that “[China’s] digital currency provides a functional alternative to the dollar settlement system.” While China was the only major economy that made a daring step toward a major milestone, governments and central banks around the world have been experimenting with blockchain and digital currencies for years. The early versions of the US stimulus bill included the development of a digital US dollar, while The European Central Bank recently released a working paper analyzing merits of its potential digital currency. Indeed, as central bankers around the world are increasingly showing interest in blockchain technologies and the global adoption of digital currencies continue, they could eventually challenge and partially replace fiat currencies, thus, creating significant monetary policy implications. In agreement, a recent report of G7 working group on as a subset of digital currencies known as stablecoins stated that “stablecoins that reach global scale could pose challenges and risks to monetary policy.” THE IMPACT OF CENTRAL BANK DIGITAL CURRENCIES CBDC would likely help monetary policy targeting money supply and enable access to real-time data regarding money demand. It would also likely be a direct liability of the central bank, while blockchain-based interbank settlement systems would be faster, auditable, and more transparent. In general, central banks influence monetary policy by changing the short-term interest rate. Additionally, monetary authorities reduce long-term interest rates by buying long-term government bonds. This process, also known as quantitative easing, increases the money supply. CBDC could help with targeting of money supply since citizens would have direct access to the central bank’s base money. It would also enable governments’ access to real-time data on money demand. Indeed, a recent research study by the Bank of England concluded that a central bank digital currency might “strengthen the transmission of monetary policy changes to the real economy.” Bitcoin supporters glorify its fixed issuance schedule with no discretionary influence of central banks or any other institution. They often present past evidence of central banks in several countries abusing their discretionary power and printing money for the benefit of various interest groups. In the case of CBDC, the central bank’s commitment problem could be potentially solved by using smart contracts to predetermine the issuance rate of the currency when predefined conditions are met. However, the pre-determined currency issuance implies that money supply would by default ignore future market factors and, hence, the future quantity of money would not be able to respond to future market conditions. THE IMPACT OF PRIVATE CRYPTOCURRENCIES When Facebook and its partners in Libra Association announced the development of cryptocurrency with a potential user base of 2.4 billion active users last June, the possibility of a private cryptocurrency replacing sovereign currency became a reality. At the Congress Hearing organized a few weeks later, Facebook’s executive David Marcus stated that The Libra Association has “no intention of competing with any sovereign currencies or entering the monetary policy arena.” However, if Libra becomes a widely adopted private currency as its founders hope, it will inevitably have monetary policy implications regardless of the founders’ intentions. Libra will be fully backed by the basket of currencies comprising the US dollar, euro, Japanese yen, pound sterling, and Singapore dollar, and, thus, it will effectively follow the monetary policies of the five central banks that issue these currencies. As regulators around the world expressed concerns that Libra could interfere with their national currencies and monetary policies, Libra was recently redesigned, and a new White Paper describes single-currency stablecoins separate from the Libra coin. Notwithstanding these changes, Libra could eventually partially replace some sovereign currencies, especially in countries with high inflation and unstable banking system. According to BIS’ report, private cryptocurrencies backed by tech giants could “rapidly establish a dominant position in global finance and pose a potential threat to competition, stability and social welfare.” Furthermore, the potential dominance of Libra or any other private cryptocurrency in a specific country would severely undermine the effects of monetary policy of that country and jeopardize its economy. If citizens start using cryptocurrency rather than local currency, weak demand would cause local currency’s depreciation. As inflation of local currency increases, it will affect even non-adopters of the cryptocurrency. In this respect, the effect of cryptocurrencies would be analogous to the dollarization – the impact of the US dollar on local currencies in some developing countries. For example, demand for local currencies in countries such as Zimbabwe or Cambodia is affected by lack of trust in the currency and, thus, locals use the US dollar as a medium of exchange. This currency substitution causes local monetary authorities to lose a set of monetary policy tools that can affect macroeconomic outcomes. On the other hand, libertarians and free market devotees claim that competition from private currencies may impose market discipline on central banks, which should improve the quality of sovereign money. Currency competition, they argue, can reduce inflation and prevent the central bank’s manipulation of interest rates. Moreover, monetary policy typically affects the real economy via central banks’ short-term interest rate, which has an impact on the bank funding cost and, thus, bank lending rates. This monetary policy pass-through is limited by the relatively strong market power that banks have over depositors. In layman’s terms, deposit rates are not very responsive to policy rate changes. However, an improved blockchain-based payment system would likely increase competition and, as a result, competitive pressures on depository system would increase the responsiveness of deposit rates to policy rates. As global adoption of cryptocurrencies continues to accelerate, policy makers expect that they will challenge and even partially replace fiat currencies in future. Central banks’ digital currencies are likely to strengthen the transmission of monetary policy and help monetary policy targeting money supply. Dominant private cryptocurrencies, on the other hand, would severely undermine the effect of monetary policy. Furthermore, they could also lead to diminishing relevance of some sovereign currencies, the loss of their value, and high inflation. Prospect of Cryptocurrencies in Islamic Finance

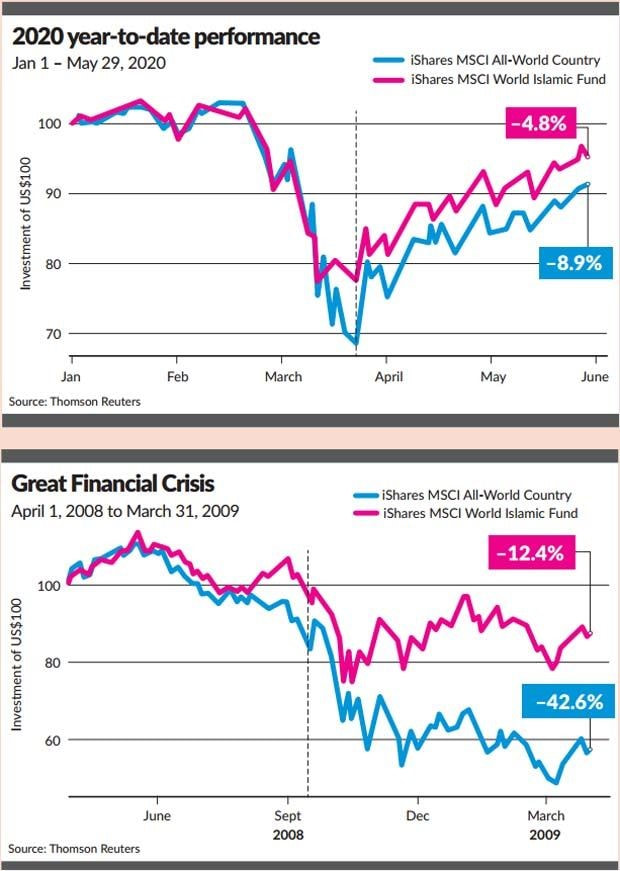

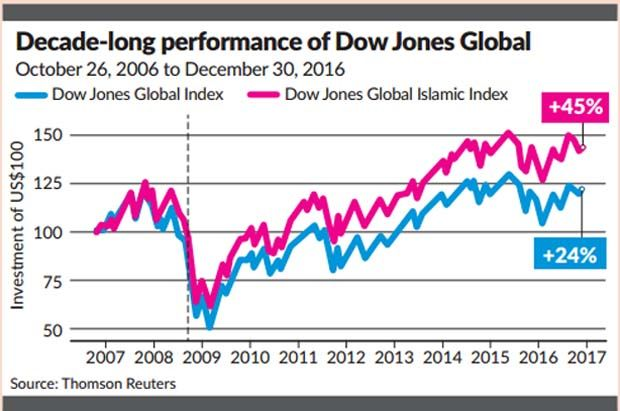

By Emir Hrnjic and Nikodem Tomczak In May of this year a mosque in London announced it would begin to accept donations in cryptocurrency form. Although many were skeptical, the mosque received four times more donations in cryptocurrency during the month of Ramadan than in traditional cash. Even before the mosque’s experiment, debate has been raging about the permissibility of cryptocurrencies under Islamic law as religious scholars deliberate the issue of sharia compliance. Some religious scholars in Egypt, Turkey, and India for example have directly opposed the use of cryptocurrencies citing various issues such as their use in illegal activities, widespread speculation and price volatility. Others, however, have declared bitcoin sharia compliant, paving the way for Islamic institutions to start accepting cryptocurrencies. Considering that the worldwide Islamic finance market recently surpassed U$2 trillion, the issue of sharia compliance has huge economic significance. Muslims make up almost a quarter of the world’s population and Muslim countries account for approximately 10 percent of global GDP. To comply with sharia, financial products should avoid interest, speculation, and excessive uncertainty. They should also be ethical and underlying contracts should be transparent, whilst Islamic financial instruments should be backed by real economic activity or a physical asset. Against these benchmarks, concerns have been raised about widespread speculation and the extreme price volatility of cryptocurrencies. Furthermore the majority of cryptocurrencies have no underlying economic activity or physical asset. However, taken to an extreme, strict interpretations of Islamic finance disapprove even of traditional fiat currencies – especially so after the gold standard was abandoned in 1971 and money lost its “real” value. As a solution, some have argued for the creation of Islamic gold dinar and Islamic silver dirham currencies, backed by gold and silver, saying that such a system would alleviate several problems of modern economies such as inflation and recurring financial crises. Whilst the ambiguity about sharia compliance has kept many devout Muslims on the sidelines, companies across the Islamic world have started incorporating blockchain and cryptocurrencies into their business models. Among ASEAN countries, Malaysian government formed partnership with Hong Kong’s iSunOne which specializes in digital banking services to develop the blockchain–based Islamic financial network and to establish a blockchain–based Islamic bank. In Indonesia, Blossom Finance offers Smart Sukuk Tokens which represent an ownership in the sukuk used in funding microfinance projects. The platform is able to reduce the cost of sukuk issuance by automating much of the legal, accounting, and payment cost. Meanwhile in the Middle East, a crypto token for money transfers received sharia certification from an advisory agency licensed by the Bahrain’s central bank, while Saudi Arabia’s monetary authority signed a partnership with blockchain firm Ripple to use the company’s platform for cross-border payment settlements. In April, Saudi British Bank (SABB) launched an instant cross-border transfer service based on Ripple’s blockchain technology. One crypto solution that seems tailor-made for sharia compliance is stablecoin – a cryptocurrency backed by a stable commodity such as gold or silver. Since the concepts of the Islamic gold dinar and Islamic silver dirham represent ideals of Islamic finance, a stablecoin backed by gold or silver provides an opportunity for an emergence of a “digital Islamic gold dinar” or “digital Islamic silver dirham.” The market value of a stablecoin theoretically equals the value of its underlying collateral deposited in a crypto company’s bank account. Hence, a stablecoin should have a stable value regardless of the ups and downs of the rest of the crypto market. This should avoid excessive volatility fueled by speculation and market manipulation, although of course gold and silver are not completely immune from these. Recently, a stablecoin issued by a Swiss firm and backed by a basket of eight fiat currencies and gold received sharia certification from a leading consultancy and audit firm in Bahrain. However, a concern for collateralized coins is that they require intermediaries including the token issuer guaranteeing redeemability of the stablecoin and the banks safekeeping of the collateral. In this case credibility of an authenticator of the commodity held in reserves would be an issue. Furthermore, the presence of intermediaries renders such schemes effectively centralized, and as a result subject to a single point of failure. Along with their impact on Islamic finance, truly resilient stablecoins would profoundly impact the cryptocurrency world in various ways. For example, enabling crypto-based loans with significantly reduced volatility risk would make a large impact on lending and borrowing markets. Moreover, stablecoins could be used for payments, remittances, salaries and many other purposes. If stablecoins prove resilient, they will unlock the blockchain potential to its fullest with the potential to even rival bitcoin as they become a truly global medium of exchange. Islamic investors and entrepreneurs are increasingly aware of the seemingly endless opportunities. While the debate over the permissibility of cryptocurrencies is still ongoing among Muslim scholars, governments must decide whether to back cryptocurrencies or risk being ostracized from the new economies. Furthermore, central banks in Muslim countries should embrace opportunities offered by the growing importance of cryptocurrencies. In that spirit, development of stablecoins backed by gold or silver will revitalize a “digital Islamic gold dinar” or “digital Islamic silver dirham” providing a tailor-made solution for sharia compliant cryptocurrencies. Marrying the cryptocurrencies with key principles of Islamic finance may finally bring the needed stability and scale to Islamic finance. Beware of Risks in Blockchain–Based Smart Contracts

By Emir Hrnjic and Nikodem Tomczak Among the many technological advances enabled by blockchain technology, such as the emergence of cryptocurrencies, smart contracts have attracted significant attention due to their potential transformative power in business and finance. Digital contracts, much like traditional contracts, outline the terms of an agreement between two or more parties but the terms are in the form of computer code residing and executed on a blockchain. The “smart” aspect of these contracts comes supposedly from their ability to automatically enforce and execute the contract provisions on the blockchain when preset conditions are met. The self-verifying, self-executing and self-enforcing nature of smart contracts removes the need for any central authority or intermediaries for the contract execution, drastically reducing the cost of doing business. Transacting parties can easily audit the smart contract code, while the blockchain technology theoretically provides a tamper–proof record of the contract code and of every transaction executed by that code, minimizing risk and greatly improving transparency and accountability. However, these contracts are arguably neither “smart” nor “contracts.” The code describing the contract provisions is not necessarily legally binding. For its obligations to be legally enforceable the transacting parties may also need real-world legal agreements to facilitate the resolution of potential disputes that would arise from human-made errors in the smart contract code. Appropriate legislation needs to be passed to recognize the legal effect of smart contracts when conducting electronic business transactions. To this end, many jurisdictions have recently passed relevant bills recognizing the legal effects of smart contracts, helping to pave the way for their wider acceptance. Smart contracts have widely proliferated on different blockchain platforms and currently underpin the emerging decentralized finance sector that facilitates funding and servicing of loans, digital securities trading, as well as initial coin offerings. Furthermore, they are poised to transform businesses by drastically cutting overhead costs, increasing efficiency by automating many business tasks, and accelerating financial transactions by reducing the likelihood of disputes. However, smart contracts are relatively new, and to achieve wider adoption, some key hurdles need to be overcome. Since a smart contract is as good as the underlying computer code, vulnerabilities and hacking that would result in loss of funds are major concerns that may force potential adopters to stay on the sidelines. In one infamous example of smart contract vulnerability, a weakness in the smart contracts code underpinning a blockchain-enabled venture capital fund, caused a loss of 3.6 million Ether (the equivalent of roughly US$50 million at the time) in 2016. The recovery of the funds came at a major reputational cost to the blockchain security and governance. Despite regulatory efforts around the world, unscrupulous developers remain a danger to the industry, while the legal uncertainties of conducting business on blockchain platforms across different jurisdiction significantly increase the risk. Before smart contracts achieve wider adoption, the code vulnerabilities and the legal frameworks need to be properly addressed. In the meantime, entrepreneurs should figure out what role smart contracts can play in defining the future of their business and factor in the risks involved. Blockchain path to more inclusive world

|